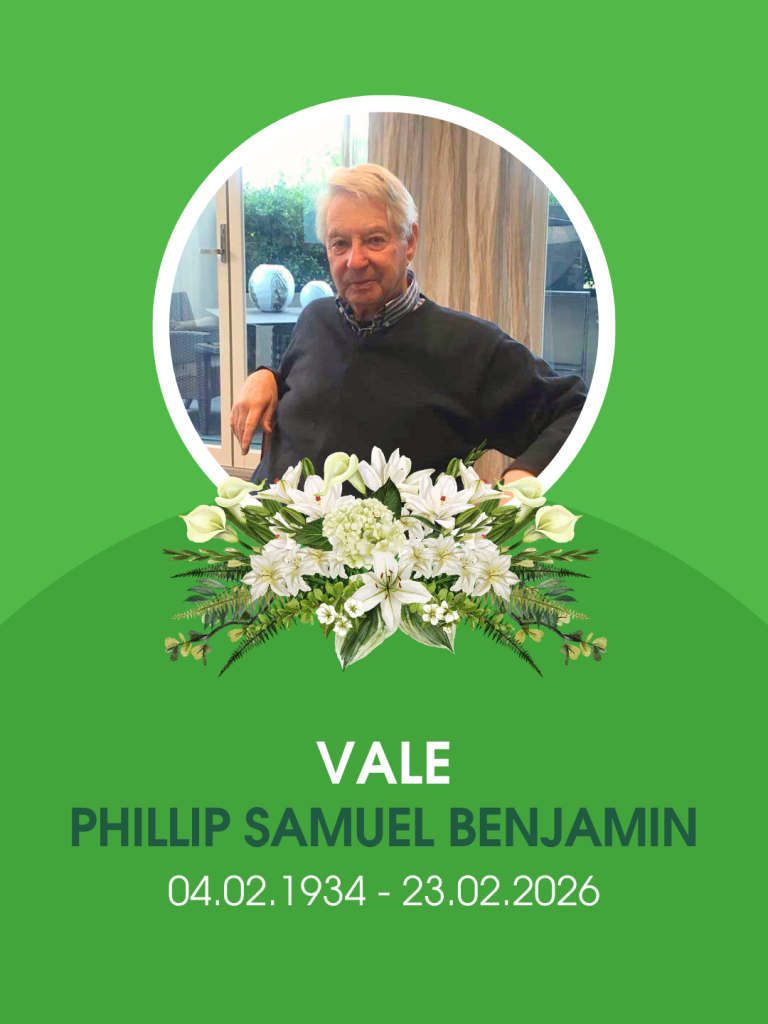

It is with great sadness that the team at DFK Benjamin King Money acknowledges the passing of Phillip Samuel Benjamin on 23 February 2026.

Phillip was the founding partner of DFK Benjamin King Money. His unwavering commitment to his clients laid the foundations for the firm we are proud to be today. Through his leadership, tireless work ethic and care Phillip helped shape our practice and the values that continue to guide us forward.

His contribution to the profession and to our firm leaves a lasting legacy. The relationships he had with our clients and colleagues that we still enjoy today are a direct reflection of Phillip’s dedication to the practice.

We remember Phillip with deep gratitude and respect. We extend our heartfelt condolences to his family, friends, colleagues and all who had the privilege of knowing and working alongside him.